Descubra como funciona o sistema tributário no Canadá, quais são seus principais impostos, obrigações fiscais, dicas para otimizar sua declaração e como evitar a bitributação. Tudo em português e com foco na realidade dos brasileiros no país.

Você sabia que muitos brasileiros residentes no Canadá pagam mais impostos do que deveriam, simplesmente por desconhecerem as regras do sistema tributário canadense?

Se você é um profissional liberal, empresário ou trabalhador assalariado e sente aquele frio na barriga só de pensar na época de declarar imposto, este guia é para você.

Vamos explicar, de forma clara, prática e com base em fontes oficiais como a Canada Revenue Agency (CRA), tudo o que você precisa saber sobre:

Quais são os principais impostos do Canadá;

Quem precisa declarar;

Como evitar bitributação com o Brasil;

Dicas para pagar menos imposto legalmente;

Erros comuns cometidos por brasileiros.

Prepare-se para transformar ansiedade em clareza, e dúvidas em estratégias inteligentes de economia fiscal!

O que é o sistema tributário do Canadá?

O sistema tributário canadense é regulamentado pela Canada Revenue Agency (CRA) e baseado no princípio da renda mundial (global income). Isso significa que se você é considerado residente fiscal no Canadá, deve declarar todos os seus rendimentos, mesmo que tenham sido obtidos fora do país, como no Brasil.

Níveis de tributação:

Federal – recolhido pela CRA;

Provincial/Territorial – varia conforme a província onde você reside (Ontario, British Columbia, Alberta, etc.);

Municipal – aplicável em casos específicos, como o Property Tax (imposto sobre propriedades).

Impostos mais comuns:

Imposto | O que é |

Income Tax | Imposto sobre a renda (o principal imposto para pessoas físicas) |

GST/HST | Imposto sobre bens e serviços (similar ao ICMS brasileiro) |

Payroll Tax | Imposto sobre salários e benefícios pagos a empregados |

Property Tax | Imposto sobre propriedades imobiliárias |

Capital Gains Tax | Imposto sobre lucros em investimentos |

Quem precisa declarar imposto no Canadá?

A regra geral é simples: se você vive no Canadá, mesmo que temporariamente, e mantém vínculos com o país, provavelmente será considerado residente fiscal.

Você se enquadra como residente fiscal canadense se:

Mora no Canadá por mais de 183 dias por ano;

Possui vínculos como casa, emprego, cônjuge ou filhos no país;

Tem permissão de residência permanente (PR) ou visto de trabalho.

A CRA utiliza critérios específicos para determinar a residência fiscal. Se você estiver em dúvida, é altamente recomendado consultar um especialista em impostos internacionais, como os da MB Tax Solutions.

Como funciona o cálculo do imposto de renda?

O Canadá adota um sistema de alíquotas progressivas, o que significa que quanto maior a sua renda, maior será o percentual de imposto que você pagará. Veja um exemplo de faixas de tributação (Federal Income Tax para 2025):

Faixa de Renda (CAD) | Alíquota Federal |

Até $53.359 | 15% |

De $53.360 a $106.717 | 20,5% |

De $106.718 a $165.430 | 26% |

De $165.431 a $235.675 | 29% |

Acima de $235.675 | 33% |

Além disso, cada província tem suas próprias faixas e alíquotas. Por exemplo, em Ontario, a alíquota provincial inicia em 5,05% e pode chegar a 13,16%.

Como evitar a bitributação entre Brasil e Canadá?

A boa notícia é que Brasil e Canadá possuem um acordo para evitar a dupla tributação, firmado em 1984.

Isso significa que, se você já pagou imposto no Brasil sobre determinado rendimento, é possível compensar esse valor na sua declaração no Canadá, evitando pagar duas vezes.

Para que isso funcione:

Mantenha todos os comprovantes de pagamentos feitos no Brasil;

Use formulários corretos na hora de declarar (como o Foreign Income Verification Statement);

Contrate especialistas em contabilidade internacional para garantir que tudo esteja conforme a legislação dos dois países.

Quais são os erros mais comuns cometidos por brasileiros?

Omissão de renda obtida no Brasil (como aluguéis, serviços online, etc.);

Não reportar contas bancárias no exterior, o que é obrigatório para residentes fiscais no Canadá;

Confusão entre residência fiscal e residência imigratória;

Tentar declarar sozinho, sem apoio de especialistas;

Não guardar documentos por tempo suficiente (CRA pode solicitar informações de até 6 anos anteriores).

Como declarar corretamente sua renda?

A declaração deve ser feita entre fevereiro e abril do ano seguinte, usando o sistema NETFILE da CRA.

Você precisará:

SIN Number (número de seguridade social)

T4 (comprovante de renda para empregados)

T5 e T3 (investimentos e rendimentos de fundos)

Comprovantes de despesas dedutíveis (educação, saúde, dependentes)

Importante: freelancers e autônomos devem usar o formulário T2125, detalhando receita e despesas operacionais.

Importante: freelancers e autônomos devem usar o formulário T2125, detalhando receita e despesas operacionais.

Quais são as deduções e benefícios fiscais?

O sistema canadense permite uma série de deduções que podem reduzir drasticamente o valor pago.

Principais deduções:

Childcare expenses (creche, babá registrada)

Medical expenses

Tuition fees (estudos)

RRSP (plano de aposentadoria privado)

Despesas com home office (para autônomos)

Benefícios:

Explore este guia completo: Deduções Fiscais no Canadá: o que pode reduzir seu imposto

Como pagar menos imposto legalmente no Canadá?

Aqui vão algumas estratégias recomendadas pela MB Tax Solutions:

Planejamento Tributário

Crie uma estratégia anual, incluindo investimentos em RRSP e decisões como vender imóveis ou ativos em anos de menor renda.

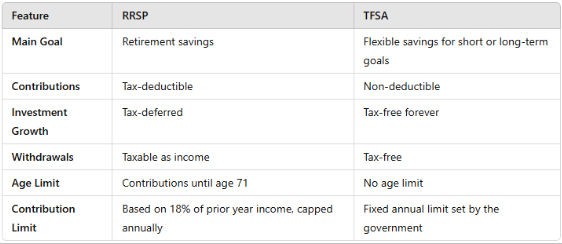

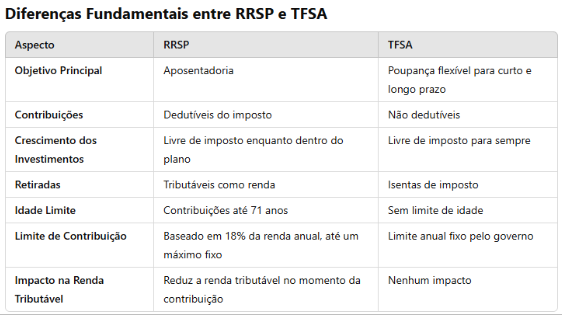

O RRSP (Registered Retirement Savings Plan) é uma das melhores estratégias legais para reduzir a base de cálculo do imposto de renda no Canadá. Cada dólar que você contribui para o RRSP pode ser deduzido da sua renda tributável.

Além disso, o rendimento dentro do RRSP cresce livre de impostos até o momento do saque, geralmente na aposentadoria — quando sua alíquota será menor.

Leia o artigo completo: Tudo o que você precisa saber para investir com sabedoria e reduzir seus impostos

Leia o artigo completo: Tudo o que você precisa saber para investir com sabedoria e reduzir seus impostos

Reorganização Financeira

Profissionais liberais podem usar estruturas como Incorporation (criação de empresa) para pagar menos imposto sobre lucro do que pessoa física.

Consultoria Especializada

Contadores genéricos podem ignorar as complexidades de brasileiros no Canadá. A MB Tax Solutions é especializada em situações binacionais.

Outras dicas importantes:

Use a conta TFSA (Tax-Free Savings Account) para ganhos livres de imposto;

Declare dependentes corretamente (isso pode gerar deduções);

Deduzir despesas relacionadas ao trabalho remoto (se aplicável);

Para autônomos, deduzir despesas com escritório, transporte e materiais.

Essas estratégias, quando aplicadas corretamente, podem gerar uma economia fiscal significativa.

Casos práticos de brasileiros no Canadá

Exemplo 1: Carla, psicóloga com renda no Brasil e no Canadá

Carla mora em Vancouver e atende pacientes tanto em português quanto em inglês. Ela emite notas fiscais no Brasil, mas por um bom tempo não sabia que precisava declarar essa renda também no Canadá. Após uma consultoria com a MB Tax Solutions, ajustou sua situação e conseguiu compensar os impostos pagos no Brasil. Hoje, ela paga menos impostos e tem total tranquilidade fiscal.

Exemplo 2: Rodrigo, desenvolvedor contratado em Toronto

Rodrigo usava o sistema gratuito da CRA, mas se sentia inseguro. Após errar na declaração e ser notificado pela CRA, contratou a MB Tax Solutions. A equipe identificou erros simples que estavam custando centenas de dólares por ano. Com a orientação correta, ele regularizou sua situação e já começou a planejar a compra do primeiro imóvel.

Por que contratar uma consultoria especializada?

A legislação fiscal canadense é complexa, especialmente para quem tem vínculos com o Brasil. Contar com uma equipe que:

…é o caminho mais seguro para manter-se em conformidade, pagar menos e dormir tranquilo.

A MB Tax Solutions oferece atendimento personalizado, humanizado e com foco em economia tributária real.

Conclusão

Entender o sistema tributário canadense é essencial para qualquer brasileiro que viva, trabalhe ou tenha renda no país. Evitar erros e aproveitar deduções legais é possível — desde que você esteja bem assessorado.

Se você sente que está no escuro, ou teme estar pagando mais imposto do que deveria, não espere o problema bater à sua porta.

Agende agora mesmo uma consulta personalizada com a MB Tax Solutions e descubra como reduzir sua carga tributária, evitar multas e se planejar com segurança!

Agende agora mesmo uma consulta personalizada com a MB Tax Solutions e descubra como reduzir sua carga tributária, evitar multas e se planejar com segurança!

Este artigo é parte da missão da MB Tax Solutions: tornar o sistema tributário mais acessível e descomplicado para brasileiros no Canadá. Se você conhece alguém que precisa ler isso, compartilhe!

Veja aqui por que a MB Tax Solutions é a escolha certa para brasileiros no Canadá:

https://mbtaxsolutions.com/2024/09/27/por-que-a-mb-tax-solutions-e-a-escolha-certa-para-brasileiros-no-canada/

Importante: freelancers e autônomos devem usar o formulário T2125, detalhando receita e despesas operacionais.

Importante: freelancers e autônomos devem usar o formulário T2125, detalhando receita e despesas operacionais. Leia o artigo completo:

Leia o artigo completo:  Learn more:

Learn more:

Precisa de ajuda para criar a melhor estratégia com o RRSP e TFSA?

Precisa de ajuda para criar a melhor estratégia com o RRSP e TFSA? WhatsApp: +1 647-856-6289

WhatsApp: +1 647-856-6289